Cape Cod Property Taxes 2025: Complete Guide to Rates, Exemptions & Savings

Last Updated: July 2025

If you're considering buying property on Cape Cod or already own real estate in this beautiful Massachusetts region, understanding property taxes is crucial for your financial planning. Cape Cod offers some of the most favorable property tax rates in Massachusetts, with significant variations across its 15 towns that can impact your annual tax burden by thousands of dollars.

Cape Cod Property Tax Rates: The Complete 2025 Breakdown

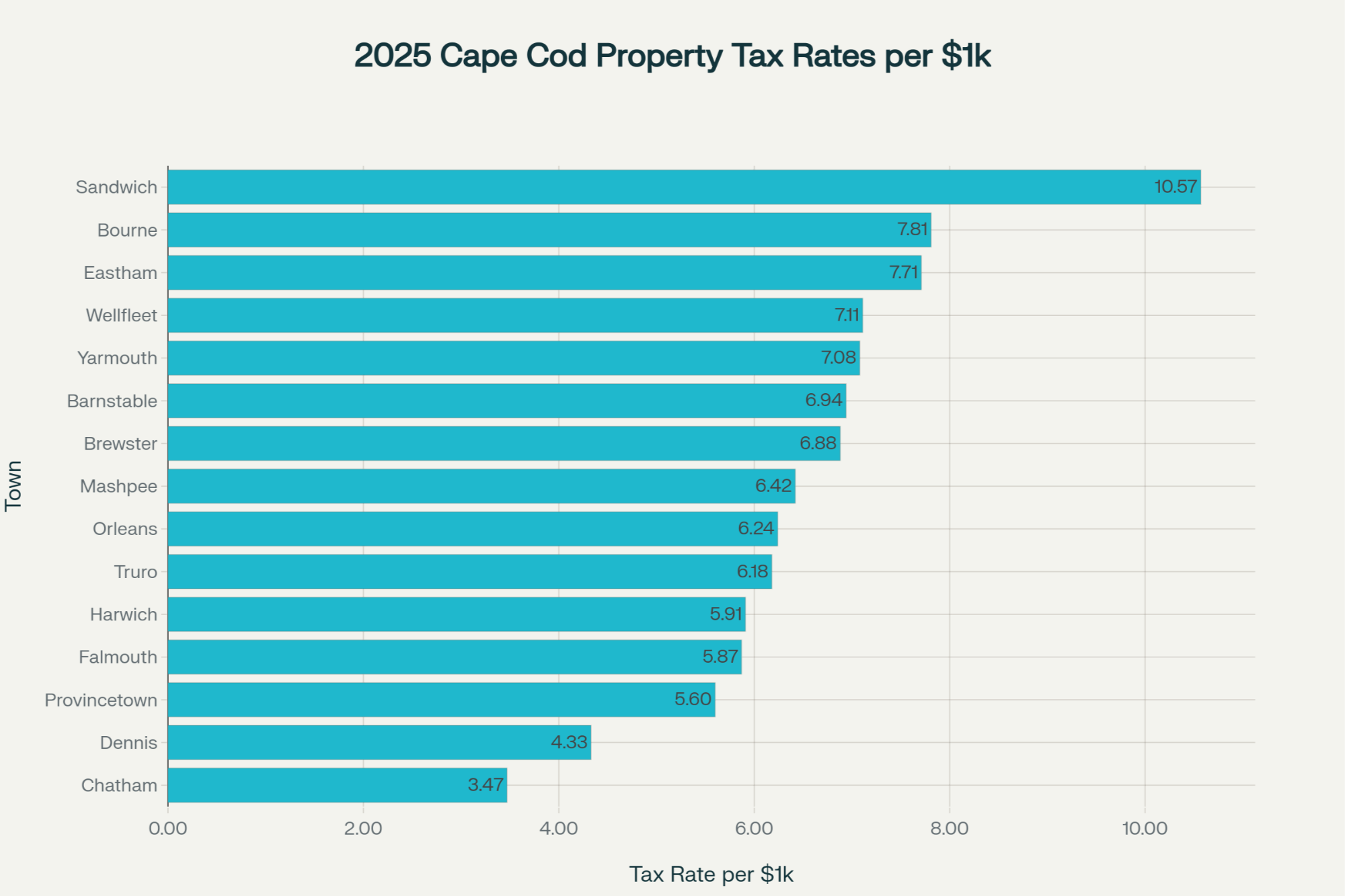

Cape Cod property taxes range dramatically from $3.47 to $10.57 per $1,000 of assessed value in 2025, with an average rate of $6.54 per $1,000 across the region. This average is notably lower than the Massachusetts state average of $12.87 per $1,000, making Cape Cod an attractive destination for property owners seeking tax efficiency.

Lowest Property Tax Rates on Cape Cod

Chatham leads with the lowest rate at $3.47 per $1,000 of assessed value, representing a 2.80% decrease from 2024. This makes Chatham particularly appealing for luxury homeowners and retirees looking to minimize their tax burden.

Other towns with competitive low rates include:

- Dennis: $4.33 per $1,000 (-1.37% from 2024)

- Provincetown: $5.60 per $1,000 (+0.36% from 2024)

- Falmouth: $5.87 per $1,000 (-15.17% from 2024)

- Harwich: $5.91 per $1,000 (-1.99% from 2024)

Complete 2025 Cape Cod Tax Rates by Town

| Town | Tax Rate per $1,000 | Change from 2024 | Cape Region |

|---|---|---|---|

| Chatham | $3.47 | -2.80% | Lower Cape |

| Dennis | $4.33 | -1.37% | Mid Cape |

| Provincetown | $5.60 | +0.36% | Outer Cape |

| Falmouth | $5.87 | -15.17% | Upper Cape |

| Harwich | $5.91 | -1.99% | Lower Cape |

| Truro | $6.18 | +3.17% | Outer Cape |

| Orleans | $6.42 | +2.23% | Lower Cape |

| Brewster | $6.88 | +1.03% | Lower Cape |

| Barnstable | $6.94 | +6.93% | Mid Cape |

| Yarmouth | $7.08 | -4.07% | Mid Cape |

| Wellfleet | $7.11 | +4.10% | Outer Cape |

| Eastham | $7.71 | +9.99% | Outer Cape |

| Bourne | $7.81 | -11.35% | Upper Cape |

| Sandwich | $10.57 | -2.13% | Upper Cape |

What These Rates Mean for Your Wallet

A $1 million home would pay approximately:

- Chatham: $3,470 annually

- Sandwich: $10,570 annually

- Difference: $7,100 per year

How Cape Cod Property Taxes Are Calculated

Understanding the calculation is straightforward: (Assessed Value ÷ 1,000) × Tax Rate = Annual Property Tax

The assessed value is determined through Massachusetts' Mass Appraisal system, which uses standardized procedures to ensure uniform and equitable valuations, based on market analysis of the previous calendar year's sales data (assessment date: January 1st preceding the fiscal year).

Cape Cod Property Tax Payment Schedule

Most Cape Cod towns use a quarterly billing system (July 1 - June 30):

Quarterly Payment Schedule

- 1st Quarter: Due August 1 (covers July 1 – September 30)

- 2nd Quarter: Due November 1 (covers October 1 – December 31)

- 3rd Quarter: Due February 1 (covers January 1 – March 31)

- 4th Quarter: Due May 1 (covers April 1 – June 30)

Note: The first two quarters are preliminary bills based on the previous year's assessment. The last two reflect the actual current value and tax rate. Some towns (e.g., Brewster, Wellfleet, Yarmouth) use semi-annual billing.

Cape Cod Property Tax Exemptions and Relief Programs

Senior Property Tax Exemptions

Clause 41C provides significant tax relief for seniors (65+) meeting income and asset criteria. For example, in Harwich, qualifying seniors with gross income below specific thresholds receive $1,500 in tax relief.

Residential Exemptions

Certain towns offer residential exemptions for primary residences. Notable examples include:

- Provincetown

- Truro

- Wellfleet

- Mashpee

- Barnstable (20% residential exemption)

Massachusetts Homestead Declaration

All residents can file a Homestead Declaration to protect up to $1 million in home equity from creditors (up from $500,000 in 2024). Homeowners automatically receive $125,000; filing increases it to $1 million.

Senior Circuit Breaker Tax Credit

This program provides up to $2,730 in refundable tax credits for seniors (65+) whose property taxes exceed 10% of their total income.

How to Appeal Your Cape Cod Property Tax Assessment

- File an abatement application with the local board of assessors (typically by February 1 for quarterly billing towns).

- If denied, appeal to the Appellate Tax Board within three months.

- Pay taxes in full to maintain the right to appeal.

Cape Cod vs. Massachusetts: Property Tax Comparison

- Barnstable County effective tax rate: 0.76%

- Massachusetts state average: 1.15%

- Median annual tax in Barnstable County: $3,929

- Massachusetts state median: $5,584

Strategic Considerations for Cape Cod Property Buyers

For Luxury Home Buyers

Choose towns like Chatham, Dennis, and Provincetown for tax-efficient high-value properties.

For Year-Round Residents

Focus on towns offering residential exemptions such as Barnstable, Provincetown, Truro, Wellfleet, and Mashpee.

For Seniors

Consider the available senior exemption programs and the Senior Circuit Breaker Tax Credit when evaluating long-term costs.

For Investment Properties

Assess the tax burden impact on rental cash flow, as investment properties typically do not qualify for primary residence exemptions.

Frequently Asked Questions About Cape Cod Property Taxes

Q: Can I pay my Cape Cod property taxes online?

A: Yes, most towns offer online payment options.

Q: What happens if I miss a payment?

A: Late payments may incur interest and penalties. Contact your local tax collector immediately if needed.

Q: How often are properties reassessed?

A: Typically, reassessments occur annually based on the previous calendar year's market data.

Q: Are exemptions filed annually?

A: Some exemptions require annual filing while others, like the Homestead Declaration, are one-time filings. Verify with your local assessor's office.

Planning Your Cape Cod Property Investment

Cape Cod's favorable property tax environment—averaging $6.54 per $1,000 compared to a state average of $12.87—combined with its scenic coastal living, offers significant savings for property buyers. Whether you're interested in a primary residence or a vacation home, understanding the tax implications is key to a smart investment.

Categories

Recent Posts

GET MORE INFORMATION